Schedule a Teams meeting

Do you have any questions about this training? Our learning specialists are happy to answer them. Schedule a Teams meeting with us now.

Schedule a meetingThe Dutch Central Bank (DNB) is responsible for prudential supervision in the Netherlands. This means: ensuring the soundness of financial enterprises and the stability of the financial system. For the various sub-sectors (banks, insurers, pension funds and investment institutions), requirements apply with respect to the level and calculation of solvency and liquidity, and controlled and sound operational management.

Although these prudential regulations for the various sub-sectors have many similarities in structure and outline, the specific requirements differ. These differences are related to the background and context in which the specific sub-sector operates. This course will help you understand the different prudential regulatory frameworks and their impact.

The implementation of prudential regulation in practice is driven by context, and varies from organisation to organisation. The background of the professionals involved in the application of prudential regulation is also diverse. During this course, we take these differences into account as much as possible. No ‘one size fits all’ approach, but sufficient attention to your specific knowledge and experience and the environment in which you work.

We only want to teach you what is relevant to you. You do not have to study theory that you already know or that is not relevant to you. However, we do offer you all the information so that you can effectively and efficiently place your own knowledge and experience or compare it with other sectors or environments.

To make this course as practical as possible, you will work on your own with the application of the different prudential frameworks to financial services. We start the course with two half-day sessions, during which we discuss the relevant prudential regulations in the financial sector and their impact. After we have gone through the theory, you carry out an assignment together with a fellow participant. In this assignment you apply the theory to practice. After submitting the assignment, you will receive individual feedback from the trainer. We then discuss the results and the insights obtained with each other during a plenary meeting.

During the course, you will be guided by two experienced trainers: Alex Poel, Co-founder and Managing Director at Charco & Dique, and Carola Steenmeijer, independent Risk consultant and former partner at KPMG’s risk consulting practice.

This course helps you understand the impact of prudential regulation on the financial sector.

Banks, insurers, pension funds and investment institutions are all subject to prudential supervision. This course has therefore been developed for anyone from the first, second or third line who has to deal with the impact of prudential regulations and wants to understand its context and learn how it affects the balance sheet and profit and loss account, also in relation to other sub-sectors in the financial sector.

This is a training at HBO (higher vocational education) level. We assume that you have a good grasp of the financial risks that a financial institution can face and how they can be managed. Furthermore, no special prior knowledge is required.

When the group consists of a mix of English and Dutch speaking participants, English will be spoken during the plenary meetings. You can choose whether you want to study the theory in the online learning environment in Dutch or in English, and in which language you want to make the assignments.

During this course you will learn:

This training consists of the following components:

During this course you will complete an assignment in which you apply the various prudential frameworks to the provision of services in the financial sector. The elaboration of this assignment is the testing element of this program. Resits consist of improving earlier work.

You will receive a certificate if you have finished the assignment to a satisfactory standard.

The basic principle is that only the trainer of the training course sees your elaboration. All trainers have signed a confidentiality agreement. You can choose to share your information with your fellow students. This will benefit the discussion in the training. It is up to you to decide if and how you want to do that: concretely, in general terms or anonymously. During the kick-off of the training we will make agreements about this together.

The duration of the training is one month. The study load varies per student, depending on the relevant prior knowledge and experience.

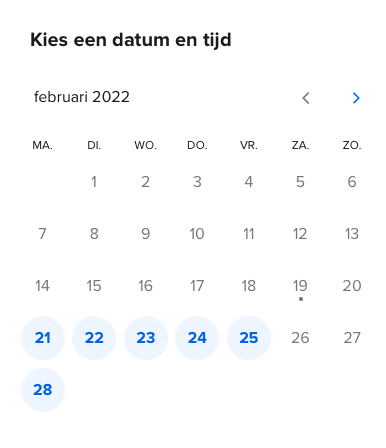

Do you have any questions about this training? Our learning specialists are happy to answer them. Schedule a Teams meeting with us now.

Schedule a meeting

New starting dates have yet to be determined. Please contact us if you want to follow this training as an individual.

The training is also available in-company, to attend with an entire team or department at once. We are happy to tailor the training to your organization and adjust the content to your policies and procedures. Please contact us for more information.

We think our courses should have practical relevance for all participants. We are happy to adapt our standard programs, so that they fit in with what is going on in your organization. You can personalize content or create a combination of subjects from different DSI programs. Read more about tour tailor-made solutions.

Our courses are easily accessible, both online and through the app of aNewSpring. You can study wherever and whenever you want.

Wealso offer ‘blended learning’ programs, in which we combine the benefits of in-class and online learning.

The Ministry of Compliance distinguishes between individual registrations and registrations on behalf of an organization. As an individual, you can sign up through the website. Just click the ‘register’ button and you can get started right away.

Organizations that want to register several employees at once can get in touch with us. We will make sure your employees can get started as soon as possible.

Demonstrable professional competence requires good reporting. That is why you can easily create and export reports within our online learning environment via a free accessible dashboard. As an individual participant you can keep track of your own progress. As an organization you can also appoint a contact person who has insight into the progress reports of the entire group of participants.

The Ministry of Compliance is an initiative of Projective Group, specialists in financial laws and regulations. Our courses are developed by experienced consultants, supplemented with knowledge from external experts.