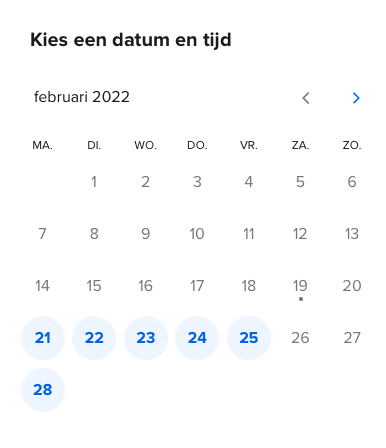

Schedule a Teams meeting

Do you have any questions about this training? Our learning specialists are happy to answer them. Schedule a Teams meeting with us now.

Schedule a meetingThe Alternative Investment Fund Managers Directive (AIFM) is a European directive. The AIFMD has been in force since 2013 and aims to harmonise European regulations for alternative investment funds, AIFs. Under the AIFMD, investment fund managers require an AIFMD license to manage or market one or more alternative investment funds. In this e-learning we will discuss in outline what entities require an AIFMD license and which licensing and ongoing requirements apply.

This awareness e-learning is relevant to all professionals who (will) have to meet the legal requirements imposed on alternative investment funds.

Contrary to what the ‘A’ of ‘alternative’ might suggest, the scope of the AIFM Directive is broad. The AIFMD applies to all managers of investment funds that do not qualify as UCITS, unless there is an exemption. It does not matter what they invest in.

After finishing the e-learning, you will know when an investment fund manager requires an AIFMD license and what requirements have to be met to obtain and retain the license.

This e-learning is a course at HBO (higher vocational education) level. We assume that participants already have some prior knowledge of fund management. For those who want to brush up their knowledge in this area, the training contains an appendix with information about investing and investment funds in general.

This course will teach you the broad outlines of the AIFMD, the regulation of alternative investment funds. In this e-learning we will discuss:

After the e-learning, you will know what requirements have to be met to obtain and retain an AIFMD license.

Using a number of open questions with standardised answers, you will learn to apply the main rulers of the AIFMD in simple practical situations. The questions of the practice test are representative for the final test and help you to determine whether you have mastered the material sufficiently.

*As an appendix to this course you will find a theory section about investing and investment funds in general. The purpose of this section is to brush up your investment knowledge if necessary. The appendix is not part of the test.

You will complete this course with a test in the learning environment. You can also take resits in the learning environment.

After passing the test, you can download your personal certificate from the learning environment.

You can follow this Awareness training in our online learning environment, wherever and whenever it suits you.The training takes between two and three hours to finish, depending on your prior knowledge about the subject.

Do you have any questions about this training? Our learning specialists are happy to answer them. Schedule a Teams meeting with us now.

Schedule a meeting

Interested in a hands-on training course that your employees will enjoy? Please feel free to contact us for more information about the possibilities.

We think our courses should have practical relevance for all participants. We are happy to adapt our standard programs, so that they fit in with what is going on in your organization. You can personalize content or create a combination of subjects from different DSI programs. Read more about tour tailor-made solutions.

Our courses are easily accessible, both online and through the app of aNewSpring. You can study wherever and whenever you want.

Wealso offer ‘blended learning’ programs, in which we combine the benefits of in-class and online learning.

The Ministry of Compliance distinguishes between individual registrations and registrations on behalf of an organization. As an individual, you can sign up through the website. Just click the ‘register’ button and you can get started right away.

Organizations that want to register several employees at once can get in touch with us. We will make sure your employees can get started as soon as possible.

Demonstrable professional competence requires good reporting. That is why you can easily create and export reports within our online learning environment via a free accessible dashboard. As an individual participant you can keep track of your own progress. As an organization you can also appoint a contact person who has insight into the progress reports of the entire group of participants.

The Ministry of Compliance is an initiative of Projective Group, specialists in financial laws and regulations. Our courses are developed by experienced consultants, supplemented with knowledge from external experts.