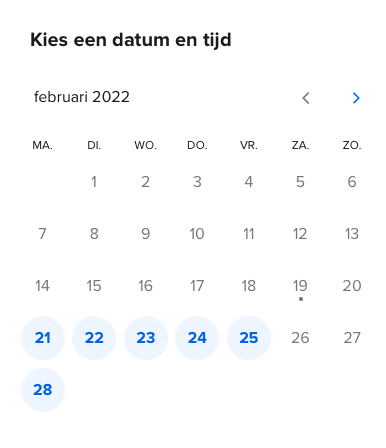

Schedule a Teams meeting

Do you have any questions about this training? Our learning specialists are happy to answer them. Schedule a Teams meeting with us now.

Schedule a meetingThe law requires certain financial institutions to conduct a systematic integrity risk analysis (SIRA). The purpose is to identify the inherent integrity risks in order to take appropriate measures to control these risks.

Regulators DNB and AFM pay special attention to the SIRA. This training helps you to successfully conduct a SIRA and thus meet the requirements of the regulators.

In practice, the process of conducting a systematic integrity risk analysis is often similar. However, the context in which you conduct a SIRA differs from organisation to organisation. The background of the people involved is also diverse. During this training we take these differences into account as much as possible. No ‘one size fits all’ approach, but sufficient attention for your specific knowledge and experience and the environment in which you work.

We want you to learn what is relevant to you. This means that you do not have to study theory that you already know or that is not applicable to your organisation. However, we do offer you all the information you need to conduct a good SIRA.

To make this training as practical as possible, you will focus on conducting a SIRA yourself. We will start the course with a short kick-off. After you have gone through the theory in our online learning environment, you will carry out an assignment in your own organisation. After handing in the assignment, you will receive individual feedback from the trainer. Then, we discuss the pitfalls and best practices with each other during a plenary meeting. Throughout the training you will be guided by an experienced compliance specialist from Projective Group

A central element of the training is conducting a SIRA in your own context.

Banks, insurers, pension funds and trust offices are all obliged to perform a SIRA. However, a SIRA is also a good way for other financial organisations to gain insight into integrity risks and their control. This training has therefore been developed for everyone from the first, second or third line who is directly involved in performing a SIRA and wants to learn how to do this successfully.

This training is available in-company, to attend with an entire team or department at once.

This is a training at HBO (higher vocational education) level. As a starting point, we assume that you have a good idea of the integrity risks that a financial organisation can face and how these can be managed.

If the group consists of a mix of English and Dutch speaking participants, English will be spoken during the plenary meetings. The theory is available in Dutch and English. You can decide whether you want to do the assignments in Dutch or English.

During this course you learn to:

The knowledge you need for this can be found in the theory part of this course.

This course consists of the following components:

1. Kick-off meeting via Teams to introduce the training;

2. Self-study via the online learning environment;

3. Carrying out the assignment in your own organisation;

4. Individual feedback on your assignment;

5. Plenary meeting to discuss elaborations, best practices, pitfalls, etc.;

6. If necessary: refining the details of the assignment.

Central to the course is doing a SIRA in your own context. The elaboration of this is the testing element of this course. The resit consists of improving previous assignments based on the plenary session, the substantiation of the assessment and the tips provided by the trainer.

You will receive a certificate if you have completed the assignment to a satisfactory standard.

The SIRA methodology used in this course is also applicable to the mandatory risk assessment under the Wwft. A Wwft risk assessment is limited to the risks of money laundering, financing of terrorism and circumvention of sanction regulations, whereas the SIRA covers all forms of integrity risks. Other forms of client integrity risks – such as fraud or tax evasion – are also part of Wwft policies and procedures in practice. The SIRA provides a good basis for this.

The compliance specialists of Projective Group that lecture this course therefore advise to conduct the Wwft risk assessment as part of the SIRA. And not only from an efficiency point of view. Also because when performing the SIRA you create an organisation outline and risk profile (including risk appetite). These are guiding principles for carrying out the risk assessments and for qualifying the results. In addition, they ensure that risks are focused on the nature and size of your own organisation.

The assignments in this course are carried out in your own context and based on your organisation’s issues and set-up. This may involve confidential information.

The starting point is that only the trainer of the course will see your assignments. All trainers have signed a confidentiality agreement.

You can choose to share your information with your fellow students. This will benefit the discussion in the training. It is up to you to decide if and how you want to do that: concretely, in general terms or anonymously.

This course takes about a month in total. The study load varies per student, depending on relevant prior knowledge and experience.

Do you have any questions about this training? Our learning specialists are happy to answer them. Schedule a Teams meeting with us now.

Schedule a meeting

The SIRA training is available in-company, to attend with an entire team or department at once. We are happy to tailor the training to your organisation and adjust the content to your policies and procedures. Please contact us for more information about starting dates and customisation.