Schedule a Teams meeting

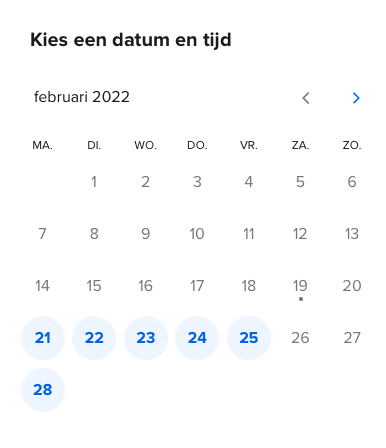

Do you have any questions about this training? Our learning specialists are happy to answer them. Schedule a Teams meeting with us now.

Schedule a meetingA practical training course that prepares professionals in a few months for a position as Compliance Officer. No ‘one size fits all’ approach, but sufficient attention for your specific knowledge and experience and the environment in which you work. That’s what this course wants to offer you.

In practice, Compliance Officers’ tasks are often similar, but the context in which they do their work varies from organisation to organisation. The backgrounds of professionals entering the compliance function are also diverse. This training takes these differences into account as much as possible.

We only want to teach you what is relevant to you. That is why we take your background, experience and knowledge into account as much as possible. We provide you with information that is relevant to the environment in which you work and the knowledge and experience you already have.

This course is suitable for professionals who (are going to) fill the role of Compliance Officer at companies within the financial sector, such as banks, investment firms and institutions, stock market companies, pension funds, trust offices or insurance companies. It is important to have a working environment in which you can carry out the practical assignments of the course.

This course is accredited by DSI. This means that the content and examination of the course meets the standards of DSI and provides access to a DSI certification.

This is an HBO (Higher Vocational Education) level course. The training is suitable for professionals with different backgrounds and experience. Relevant (prior) knowledge of laws and regulations is not required.

If the group consists of a mix of English and Dutch-speaking participants, English will be spoken during the plenary sessions. The theory will be available in Dutch and English. You can choose to do the exercises in Dutch or English.

This course prepares you for the role of Compliance Officer. The programme focuses on the ‘compliance cycle’ and the tasks you need to be able to perform as a compliance officer. The assignments measure your ability to do this.

For each step in the compliance cycle, you will perform one or more tasks. In this way, you learn to perform all the tasks for which you are responsible as a compliance officer.

Each module starts with a one-hour online plenary session where the trainer introduces the module and discusses the assignment for that module. You will then have one month to complete the assignment, applying it to your specific working environment. You will be supported by your personal mentor, a Projective Group consultant, who will act as your sparring partner and advisor.

After the assignment has been submitted, another plenary meeting takes place. Common learning points, pitfalls and best practices will be discussed. After this meeting, you will have the opportunity to further refine the details of your assignment before submitting the final version. The final versions of the assignments are collected in a portfolio and together they form the final assessment.

More information on the content of the modules can be found in the brochure for this course.

Upon completion of the course, you will receive a diploma and may use the title ‘Qualified Compliance Officer’.

The theory is presented in an engaging online learning environment. All students are assigned a personal mentor to support them throughout the training programme. These mentors are experienced Charco & Dique consultants who act as external compliance officers for various types of companies in the financial sector. The consultants provide you with practical tools, such as sample documents and templates, which they also use in practice.

During your training, you will not only learn the theory you need to master as a Compliance Officer. To excel at your job, soft skills are just as important. When learning soft skills, trust is an important driver for success. In difficult circumstances, such as giving negative feedback, it helps to be able to practice in a safe environment.

This is why participants can practice at home with OWNIT’s VR skill training. Using VR goggles, you practice various ‘difficult’ scenarios, such as addressing unwanted behavior and dealing with resistance to new rules. Learn more by watching the video below.

For each step in the compliance cycle, you will complete one or more tasks. To help you, you have access to Regtech tool Ruler. The regulatory framework in Ruler contains the relevant laws and regulations for all types of financial institutions. You can also use Ruler to perform the other steps in the compliance cycle, such as performing risk analysis and creating a monitoring plan.

Already using Ruler compliance software? Then we can offer you a reduced price for the Compliance Officer course. You can indicate this during the registration process.

The Compliance Officer training takes 9 months. The average study load varies per student, depending on the relevant prior knowledge and experience. You can expect to spend between 6-12 hours per module (not including the lessons).

Wondering how the first group of participants have experienced our Compliance Officer training? Read more in this blog.

Do you have any questions about this training? Our learning specialists are happy to answer them. Schedule a Teams meeting with us now.

Schedule a meeting

The next group of participants will start in October 2024.

You can register via the buttons on the right side of your screen. Would you like to enroll several students at once, or do you have questions about the training? Please do not hesitate to get in touch.