Schedule an online meeting

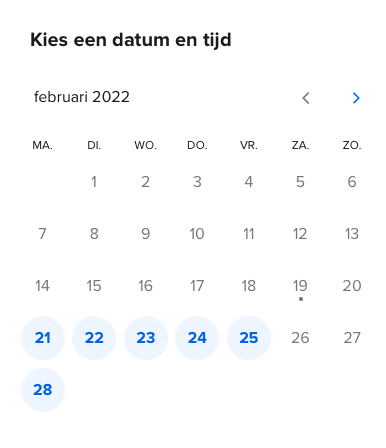

Do you have any questions about this training? Our learning specialists are happy to answer them. Schedule a Teams meeting with us now.

Schedule an online meetingAs an employee in the financial sector, you can play an important role in the fight against financial economic crime. If you can recognise certain suspicious signals or transactions and know how to act on them, you can help your organisation comply with the relevant laws and regulations and prevent both financial and reputational damage.

This awareness training helps you meet the legal training requirements deriving from the Money Laundering and Terrorist Financing Prevention Act (Wwft). After completion, you will be familiar with various forms of financial-economic crime and know how to recognise them in practice.

This training is developed for employees in the financial sector. The training is also relevant for those who are not engaged in client contact or CDD/KYC activities on a daily basis. The law requires all employees of financial organisations to have some knowledge in the field of preventing money laundering and other forms of financial crime. This training will help you meet these legal requirements.

This is a training at HBO (higher vocational education) level. Specific knowledge is not required, but we do assume that you have basic knowledge of provisions of the Wwft and financial services.

This training is designed to complement our Wwft Awareness and Sanctions Regulation Awareness trainings. It is also of added value for those who have completed our Wwft Transaction Monitoring and Wwft Customer Investigation trainings. The theory on customer due diligence and transaction monitoring will be repetitive for this group and helps them to refresh their knowledge in this area. Unlike the other in-depth courses, the FEC Awareness training focuses on practical recognition of signals that may indicate financial crime.

Learn more about detecting financial-economic crime in practice

During this training you will learn more about detecting, preventing and combating various forms of financial-economic crime, such as money laundering, terrorist financing, sanctions, fraud, corruption and tax evasion. After completing the training you:

The training starts with a baseline measurement to determine whether you can take the test immediately or whether it is best to study the theory first.

You can complete this course with a test in the learning environment. You can also take resits in the learning environment.

After passing the test, you can download your personal FEC Awareness certificate from the learning environment.

The Financial Economic Crime Awareness training can be taken via our online learning environment, wherever and whenever it suits you. The training takes between one and two hours to finish, depending on your prior knowledge about the subject.

We are happy to adapt the training to your organisation, e.g. by adding personalised cases and red flags. Please reach out to us to discuss the possibilities.

In our online learning environment, employers can view and export the progress of individual participants via a freely accessible dashboard. This provides you with an overview of the participants, courses and content statistics of all the courses taken within your organisation. Please ask for the possibilities during the registration progress.

Do you have any questions about this training? Our learning specialists are happy to answer them. Schedule a Teams meeting with us now.

Schedule an online meeting

Interested in a hands-on training course that your employees will enjoy? Please feel free to contact us for more information about the possibilities.

We think our courses should have practical relevance for all participants. We are happy to adapt our standard programs, so that they fit in with what is going on in your organization. You can personalize content or create a combination of subjects from different DSI programs. Read more about tour tailor-made solutions.

Our courses are easily accessible, both online and through the app of aNewSpring. You can study wherever and whenever you want.

Wealso offer ‘blended learning’ programs, in which we combine the benefits of in-class and online learning.

The Ministry of Compliance distinguishes between individual registrations and registrations on behalf of an organization. As an individual, you can sign up through the website. Just click the ‘register’ button and you can get started right away.

Organizations that want to register several employees at once can get in touch with us. We will make sure your employees can get started as soon as possible.

Demonstrable professional competence requires good reporting. That is why you can easily create and export reports within our online learning environment via a free accessible dashboard. As an individual participant you can keep track of your own progress. As an organization you can also appoint a contact person who has insight into the progress reports of the entire group of participants.

The Ministry of Compliance is an initiative of Projective Group, specialists in financial laws and regulations. Our courses are developed by experienced consultants, supplemented with knowledge from external experts.