Schedule a Teams meeting

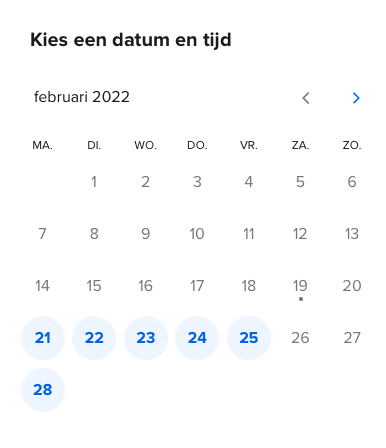

Do you have any questions about this training? Our learning specialists are happy to answer them. Schedule a Teams meeting with us now.

Schedule a meetingDemonstrable knowledge of the Wwft and Sanctions regulation is a prerequisite for employees of a financial institution. However, AML training only makes sense if it is in line with day-to-day activities.

A certain level of knowledge of the legal requirements and regulations is important for the proper conduct of a customer investigation. But a customer investigation can also be detective work and requires a good dose of analytical skills. How do you analyse and evaluate the information you have about a client? How do you draw conclusions? And just as importantly, how do you record your conclusions?

This course is designed to build on the knowledge you already have about compliance with the Wwft and Sanctions Act, e.g. from our Wwft Awareness course. During the course we will help you in a practical way to go through the steps of customer research: analyse, assess, conclude and record.

This in-depth training is intended for employees who are directly involved in the execution of the Customer Due Diligence process, but is also of interest to Compliance Officers.

This in-depth course is the next step after completing our Wwft Awareness course. This is an HBO (Higher Vocational Education) level course. There are no specific prerequisites for this course. However, we assume that you have at least a general idea of the requirements that the Wwft and Sanctions Act places on financial institutions and their employees.

Upon successful completion of the program, your understanding of the legal requirements in the area of customer due diligence under the Wwft, and the background to it, has been enhanced. You will also have been able to practice the skills you need in customer investigation.

The training:

The e-learning starts with an overview of the legal framework. What is expected of the company when it comes to determining whether its (potential) customers have integrity? On this basis we translate it into practice. Where possible, we make use of concrete examples and cases.

The training starts with a baseline measurement to determine whether you can take the test immediately or whether it is best to study the theory first.

The following topics will be covered during the training:

The e-learning takes an average of four hours to complete, depending on your prior knowledge of customer investigation.

We are happy to customize our Wwft courses for you, so that they fit the policy and integrity risk appetite of your organization. We can also supplement the courses with examples from your daily practice. This way you can be sure that your employees have the right knowledge and skills to effectively combat money laundering and terrorist financing.

Do you have any questions about this training? Our learning specialists are happy to answer them. Schedule a Teams meeting with us now.

Schedule a meeting

Interested in a hands-on training course that your employees will enjoy? Please feel free to contact us for more information about the possibilities.

We think our courses should have practical relevance for all participants. We are happy to adapt our standard programs, so that they fit in with what is going on in your organization. You can personalize content or create a combination of subjects from different DSI programs. Read more about tour tailor-made solutions.

Our courses are easily accessible, both online and through the app of aNewSpring. You can study wherever and whenever you want.

Wealso offer ‘blended learning’ programs, in which we combine the benefits of in-class and online learning.

The Ministry of Compliance distinguishes between individual registrations and registrations on behalf of an organization. As an individual, you can sign up through the website. Just click the ‘register’ button and you can get started right away.

Organizations that want to register several employees at once can get in touch with us. We will make sure your employees can get started as soon as possible.

Demonstrable professional competence requires good reporting. That is why you can easily create and export reports within our online learning environment via a free accessible dashboard. As an individual participant you can keep track of your own progress. As an organization you can also appoint a contact person who has insight into the progress reports of the entire group of participants.

The Ministry of Compliance is an initiative of Projective Group, specialists in financial laws and regulations. Our courses are developed by experienced consultants, supplemented with knowledge from external experts.