Schedule a Teams meeting

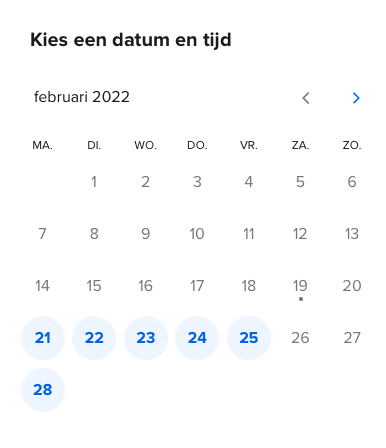

Do you have any questions about this training? Our learning specialists are happy to answer them. Schedule a Teams meeting with us now.

Schedule a meetingThe United Nations (UN) and the European Union (EU) impose international sanctions against countries, organisations, companies, and individuals. These may include financial sanctions. Financial institutions have a role in ensuring compliance with these sanctions.

Financial institutions are not allowed to facilitate payments to and from accounts of sanctioned parties or provide financial services to them. This means, among other things, blocking the accounts of these parties.

In the Netherlands, these obligations are laid down in the Sanctions Regulation. With this awareness e-learning, we bring you up to speed on the requirements that the sanctions regulation imposes on financial institutions and their employees.

Would you like to know more about the Wwft? Then take a look at our Wwft courses.

The Sanctions Regulation Awareness e-learning is suitable for professionals in the financial sector who monitor clients and transactions, and need to be familiar with the provisions of the Sanctions Regulation.

This is an e-learning at HBO (higher vocational education) level. Specific knowledge is not required, but we do assume that you have basic knowledge of financial services and the Wwft.

This course aims to familiarise you with the (European and Dutch) Sanctions Regulation. The Sanctions Regulations from the US and the UK are also discussed. This way, you will learn which requirements you and your employer must meet.

After completing the Sanctions Regulation Awareness e-learning, you know how sanction and transaction screening works and how the AFM and DNB supervise compliance with the Sanctions Regulation.

We can adapt the Sanctions Regulation Awareness e-learning to various types of financial institutions, such as trust offices. Do you need institution-specific examples or content? Ask about the possibilities during the quotation process.

The training starts with a baseline measurement to determine whether you can go straight to the test or whether it is better to study the subject first.

You will complete this course with a test in the learning environment. You can also take resits in the learning environment.

After passing the test, you can download your personal certificate from the learning environment.

You can follow the Sanctions Regulation Awareness course in our online learning environment, wherever and whenever it suits you. The e-learning takes on average between one and two hours to complete, depending on your prior knowledge.

Do you have any questions about this training? Our learning specialists are happy to answer them. Schedule a Teams meeting with us now.

Schedule a meeting

Interested in a hands-on training course that your employees will enjoy? Please feel free to contact us for more information about the possibilities.